Understanding Stainless Steel Kitchen Utensils Tariff Codes: A Comprehensive Guide

In today’s globalized economy, international trade is the backbone of many industries. For manufacturers, exporters, and importers, understanding the intricacies of tariff codes is essential. Tariff codes determine the duties and taxes applicable to goods and facilitate smooth customs clearance and compliance with international trade regulations. In this comprehensive guide, we will delve into the world of tariff codes, exploring their structure, role, and importance. We will also provide specific information on tariff codes for stainless steel kitchen utensils and offer guidance on checking these codes in various countries. Whether you are a seasoned exporter or new to the market, this guide will equip you with the knowledge needed to navigate the complexities of international trade effectively.

What are Tariff Codes?

Tariff codes, also known as Harmonized System (HS) codes, are standardized numerical classifications used globally to identify products in international trade. These codes are crucial for customs authorities to identify products, determine applicable duties and taxes, and compile trade statistics. Originating from the Harmonized Commodity Description and Coding System (HS) established by the World Customs Organization (WCO), tariff codes streamline global trade by providing a universal language for product classification. It’s utilized by over 200 countries worldwide, ensuring consistency and efficiency in international commerce.

The Structure of Tariff Codes

Tariff codes are typically composed of six digits, with additional digits added by individual countries to provide further detail. The first six digits are internationally recognized, while the remaining digits can vary by country, allowing for more specific product classification.

Each set of digits offers specific information about the product:

First two digits: Represent the product’s chapter in the HS, covering a broad category of goods.

Next two digits: Indicate the heading, offering a more precise classification within the chapter.

Next two digits: Define the subheading, giving an even finer level of detail.

Additional digits: These may be added by countries to further specify products for national purposes, such as tariffs, quotas, or statistical data.

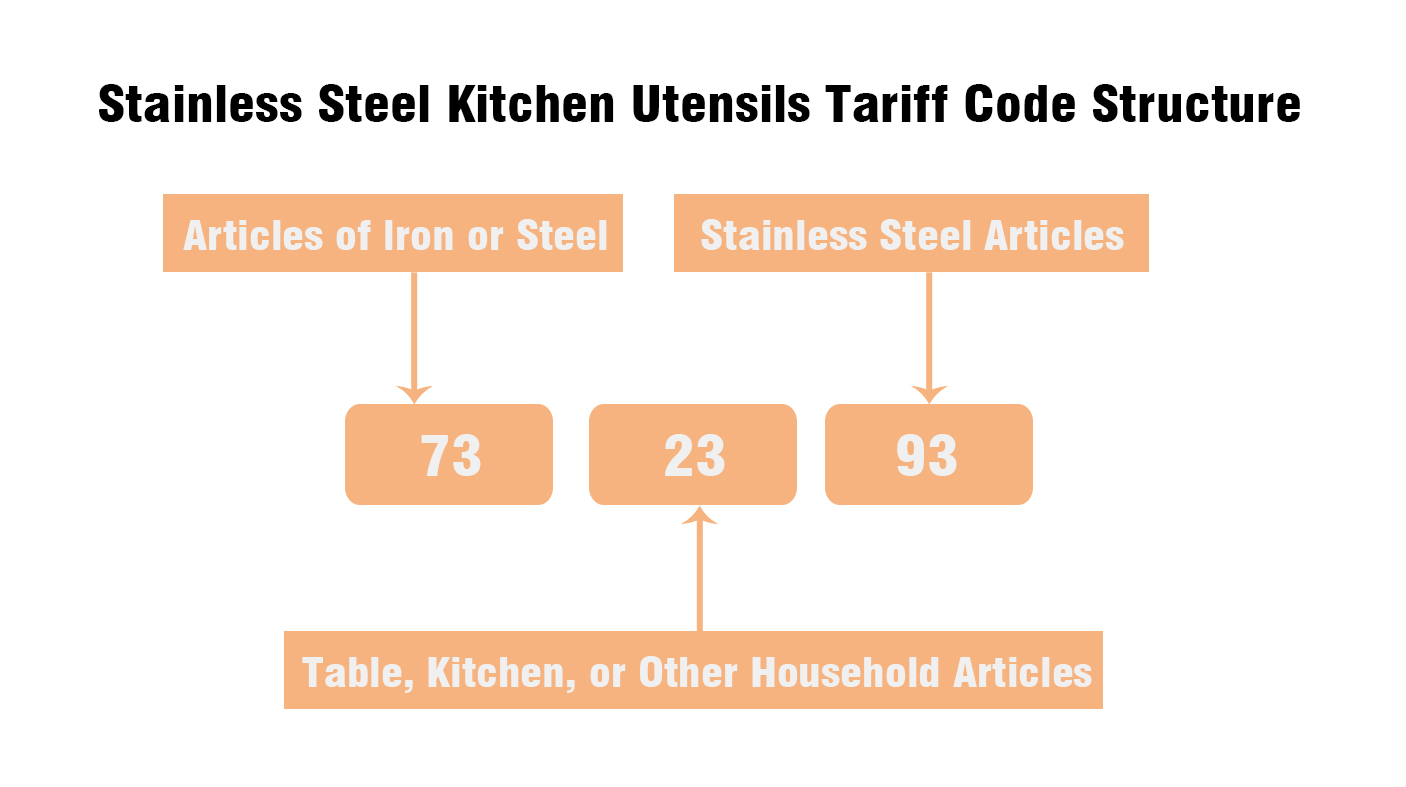

For example, a stainless steel kitchen utensil might be classified under code 73 23 93:

- 73 represents articles of iron or steel.

- 23 specifies table, kitchen, or other household articles.

- 93 narrows it down to stainless steel articles.

The Significance of Tariff Codes

Tariff codes serve several key roles in international trade:

Classification: They categorize goods, ensuring a standardized understanding between trading partners.

Duty Assessment: Customs authorities use tariff codes to determine applicable duties and taxes.

Trade Policy Enforcement: They help enforce trade agreements, embargoes, and import restrictions.

Statistical Analysis: Governments and organizations analyze trade data to inform economic policies and business decisions.

Importance of Accurate Tariff Codes

Accurate tariff codes are essential for smooth international trade operations. Misclassifying products can lead to several issues, including:

Incorrect Duties: Overpaying or underpaying tariffs can result in financial losses or penalties.

Customs Delays: Misclassification can cause goods to be held at customs, disrupting supply chains.

Legal Consequences: Non-compliance with trade regulations can lead to fines or legal action.

Trade Data Inaccuracy: Incorrect codes can skew trade statistics, affecting economic analyses and decisions.

Tariff Codes for Stainless Steel Kitchen Utensils

Stainless steel kitchen utensils fall under specific tariff codes depending on their exact nature and use. Common HS codes for these items include:

- 7323.93: Table, kitchen, or other household articles and parts thereof, of stainless steel.

- 8215.99: Other spoons, forks, ladles, skimmers, cake servers, fish knives, butter knives, sugar tongs, and similar kitchen or tableware.

These codes help customs officials quickly identify the type of product and apply the appropriate duties and regulations.

Finding Stainless Steel Kitchen Utensil Tariff Codes Across Different Countries

Finding the correct tariff codes for stainless steel kitchen utensils can vary depending on the country. These codes determine duty rates and import regulations, making it crucial for businesses to confirm the accurate codes for their target markets. Below are helpful links to check tariff codes in various key regions:

| United States – Harmonized Tariff Schedule (HTS) | HTSUS |

| European Union – TARIC (Integrated Tariff of the European Union) | TARIC |

| Canada – Canadian Customs Tariff | Canada Tariff |

| Mexico – Mexican Harmonized Tariff Schedule | MHTS |

| Brazil – Mercosur Common Nomenclature (NCM) | NCM |

| Norway – Norwegian Customs Tariff | Tolltariffen |

| Australia – Australian Harmonized Export Commodity Classification (AHECC) | AHECC |

| New Zealand – Working Tariff Document of New Zealand | NZ Customs |

| Japan – Customs Tariff Schedules of Japan | Japan Customs |

| Malaysia – Royal Malaysian Customs Department | Malaysia Customs |

Understanding the Impact of Various Tariff Codes

The selection of tariff codes plays a crucial role in determining tariff rates and, consequently, exerts a substantial influence on multiple facets of international trade, including pricing dynamics, operational efficiency, and market competitiveness.

1. Pricing and Cost Management

Choosing different tariff codes can lead to varying import duty rates, directly impacting the overall expenses associated with importing goods. These costs typically get transferred to consumers, influencing the final pricing of products in the market.

2. Operational Efficiency

Accurate classification of goods with appropriate tariff codes facilitates smoother customs clearance processes. This efficiency helps minimize delays and reduces expenses related to storage and handling, thereby enhancing operational efficiency for businesses involved in international trade.

3. Market Competitiveness

Opting for tariff codes that incur lower duties can enhance the competitiveness of products in the markets. Conversely, higher tariff rates may diminish competitive advantage. Thus, the strategic selection of tariff codes is crucial for businesses aiming to maintain or improve their market position globally.

Conclusion

Understanding and accurately applying tariff codes is crucial for any business involved in international trade. At SHUANGYI, we recognize the importance of precise tariff classifications to ensure compliance, avoid unnecessary costs, and facilitate smooth trade operations with our customers. As a leading manufacturer of stainless steel kitchen utensils, we are committed to providing high-quality products that meet global standards and satisfy our customers’ needs. For more information about our products and services, please visit our website or contact our customer support team.